National Market Report: The State of the Office Market — End of Summer Update

What is the current state of the national office market?

The factors driving the office market evolution in nearly every major U.S. market and across every asset class have created tremendous opportunities for healthy tenants.

Our team at CBIZ Gibraltar is always monitoring conditions, and there are several key insights that can benefit tenants leveraging the current landscape for economic advantage.

Momentum is Building as Construction and Sublease Additions Slow

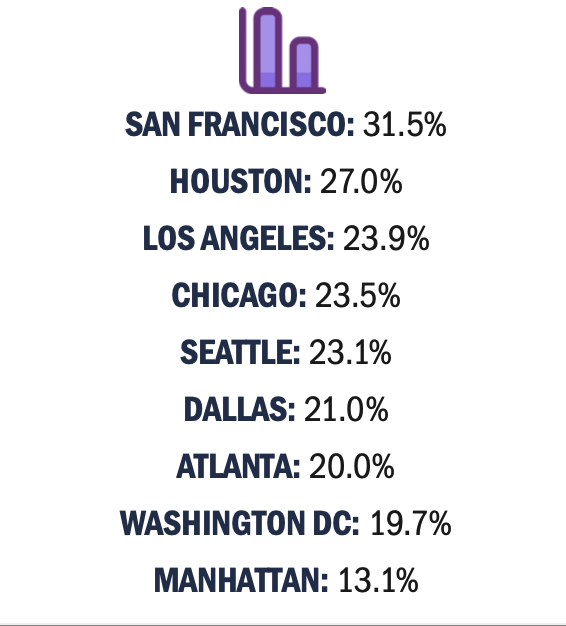

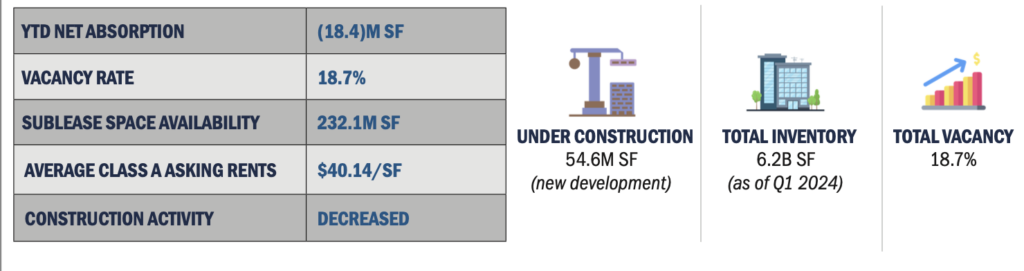

Markets across the US remain soft and tenant favorable. Vacancy is expected to hold around ~20% into 2025, but leasing volume has increased and is continuing to gain momentum. This will have an impact on the national vacancy rate, which currently sits at 18.7% (suburban) and 20.3% (CBD) — with mid-year averages showing as high as 31.5% in San Francisco and as low as 13.1% in Manhattan.

As tenants get their arms around their space needs and a hybrid policy, we expect slow stabilization across the market.

Construction activity decreased, along with declining sublease space additions. Sublease vacancy has declined for three consecutive quarters, with Q2 2024 bringing the most decline to date with 232.1 million sq ft of availability.

Higher Occupancy, Rising Rents, and Ongoing Flight to Quality

Office occupancy continues to increase as most firms adopt the hybrid work model, with larger and longer-term deals becoming more commonplace in recent quarters.

While asking rents rose slightly, landlords are still offering meaningful tenant improvement allowances and rent abatement packages for tenants.

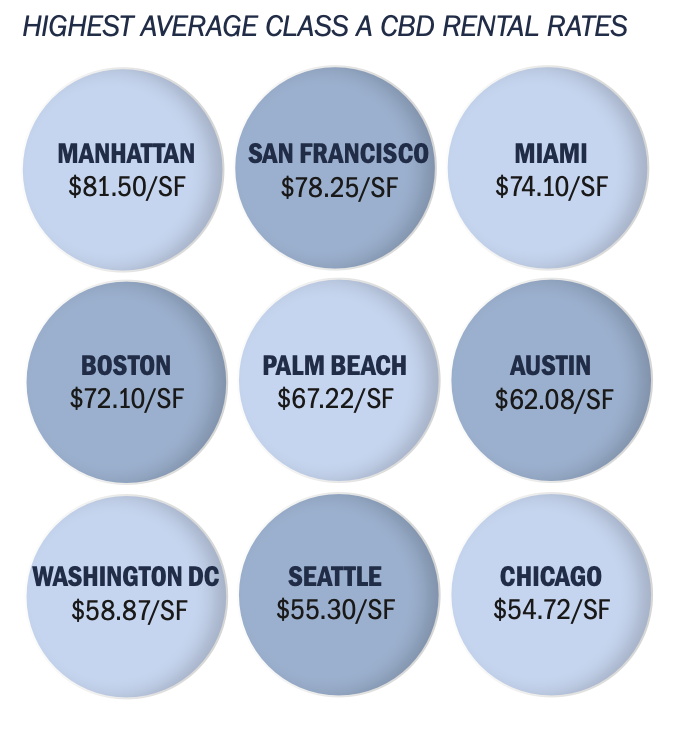

The demand for better assets has caused a slight uptick in Class A rental rate asking positions, thereby forcing landlords of lower quality, higher vacancy properties to be more creative and strategic in their leasing approach. Overall national Class A rental rates show an average of $40.14 per sq ft, and as high as $82.5 in Manhattan.

As office occupancy continues to increase within hybrid work models, there is a growing emphasis on having an abundant amount of work areas accessible to employees to ensure seating availability for all.

Employers will continue to seek a “flight to quality” in buildings, while also prioritizing a “flight to experience,” which includes workplaces located in neighborhoods with parks, restaurants, retail, etc.

The Need to Set Up for Hybrid Success

The dynamic of where, how, and when work gets done looks very different today compared to four years ago.

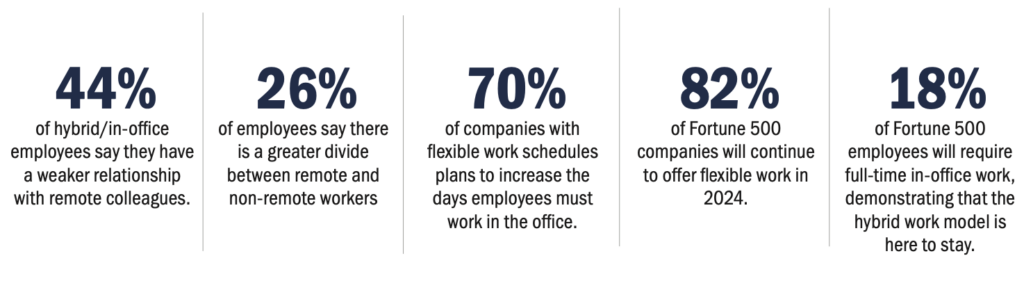

Many signs from company leaders indicate that while productively remained steady over the last few years, they are beginning to see the negative effects of their team members working from home or remotely. The greatest impact has been seen across company culture, employee engagement, collaboration, opportunities for mentorship, and employee retention.

Virtual connections are no longer viable to sustain human connection and bonding. Employees are seeking physical spaces that foster genuine interaction with peers.

Over sixty percent of companies have adopted a hybrid work model, with employees splitting the week between in-office and remote work. For most organizations, their current office space must function as a hub for collaboration and interaction and remain flexible enough to adapt to different situations.

At the same time, to attract and retain top talent, companies are looking closely at what employees want and how they can provide the right combination of in-person collaboration and remote flexibility. Optimizing the company’s physical office is crucial.

Employee wellness and well-being will continue to be a priority for employers, with a focus on spaces where employees are able to connect, recharge and refresh mentally and socially.

Supporting Tenants Needs

At CBIZ Gibraltar, we are constantly developing innovative and strategic ways to better our results for our clients. With the ever-changing market around us, tenants need a proactive approach to negotiating, evaluating, and managing their real estate needs so they can put their focus on their business goals and objectives.

2025 will be a milestone year for office space users. Whether your real estate plans are immediate or far-off, we would like to get to know you and your office space needs.