Office Market Update: Suburban Chicago – Year End Trends Shaping 2025

Our team at CBIZ Gibraltar is always monitoring conditions across office markets – and there are several key insights that can benefit tenants leveraging the current landscape for economic advantage.

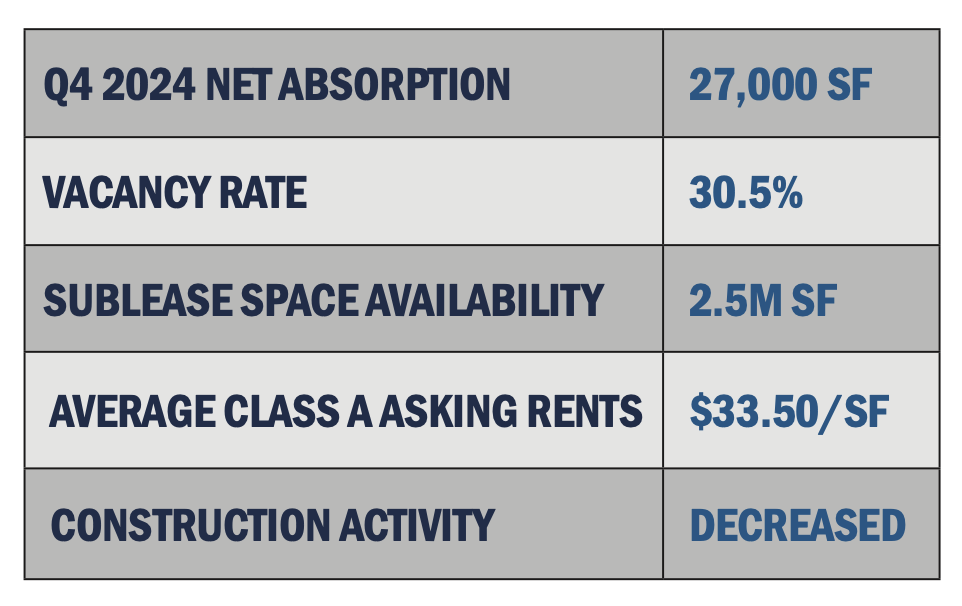

In the suburban Chicago market, leasing activity saw a slight uptick towards the end of 2024 with tenant demand focused on well located, high-quality and amenity-rich assets. Notwithstanding, overall market vacancy exceeds 30%.

The O’Hare submarket continues to maintain the lowest vacancy rate among all suburban submarkets at 22% with steady demand for office space from tenants in the market. The Northwest market had the highest vacancy rate in Q4 2024 at 36%, but there were several significant lease transactions completed in the submarket that signify an uptick in leasing momentum in the area, including Mizkan America signing a 50,500 SF lease at Woodfield Corporate Center in Schaumburg.

Overall, challenges in the suburban market remain as Landlords continue to face difficulties securing funding and debt constraints continue to impact both leasing and capital market transactions with multiple assets going into foreclosure. As organizations evaluate their suburban space requirements, having a proactive leasing strategy is key to navigating the competitive landscape of the Chicago suburbs.

VACANCY: Q4 2024 saw 27,000 square feet of positive absorption, the first quarterly gain in six quarters. However, the year-end absorption totaled a negative 730,978 SF overall. Sublease availability decreased to around 2.3%, the lowest on record in nearly four years.

O’Hare continues to lead with the lowest vacancy at 22% and Northwest market holds the higher vacancy at 36%.

ASKING RENTS: Suburban Chicago saw the following rental rates in Q4 2024:

- O’Hare Class A at 37.65/SF and $21.50/SF for Class B office space.

- East/West Corridor Class A at $32.50/SF and $19.00/SF for Class B office space.

- North submarket Class A at $33.68/SF and $18.75/SF for Class B office space.

- Northwest submarket Class A $27.10/SF and $19.05/SF for Class B office space.

LEASING ACTIVYITY: Class A properties with high-end amenities maintain the highest level of activity across all suburban submarkets. Notable deals included:

- A new 99,500 SF lease from the City of Chicago at US Cellular Plaza in O’Hare

- A 69,500 SF renewal of Invesco’s space at 3500 Lacey Boulevard in Downers Grove

- HCSC signing a 53,250 SF renewal at 1000 East Warrenville Road in Naperville.

SALES ACTIVITY: Six office properties changed hands in Q4 2024, totaling 2.6 million SF sold. Notable transactions include:

- R2 Companies acquired Innovation Park, a 1,074,199 SF campus in Libertyville for $35 million.

- Patrick Holloran purchased Presidents Plaza, a 808,600 SF building in O’Hare for $62 million.

- Onward Investors purchased One O’Hare Centre, a 380,360 SF building in O’Hare for $53 million.

As many of these decision-makers actively evaluate everything from the amount of space they need to where the offices are located and the amenities they offer, they are turning to tenant representation firms, like CBIZ Gibraltar, to better understand the costs and savings opportunities associated with their current and future lease.

As the leading provider of integrated real estate services with a 100% commitment to advocating the interests and needs of tenants, CBIZ Gibraltar understands that no two companies are alike and works to deliver the best possible solutions for our clients. Together, we uncover the potential of your work environment, maximize human capital and map the path to critical business success.