Office Market Update — Chicago Year End Report + 2025 Tenant Favorable Outlook

The Chicago office market continues to remain tenant-favorable, with tenants prioritizing well-located buildings having newer amenities and collaborative spaces.

The demand for better assets has caused a slight uptick in Trophy and Class A rental rate asking positions, but not effective rates. The demand for higher quality space has forced many landlords of lower quality, Class B and C assets to consider repurposing their usage to apartment redevelopment, thus removing these buildings from office inventory.

There has also been a significant slowdown in new office development, which has created relief to the market. Many landlords throughout the market are struggling to retain ownership of their properties, and negotiating with their lenders.

Ownerships will continue to change as opportunistic investors are able to buy properties at deep discounts, and in many cases for less than the current debt. The long-term outlook for office properties remains uncertain, but in cases where there is strength in ownership, opportunities for tenants will continue to exist.

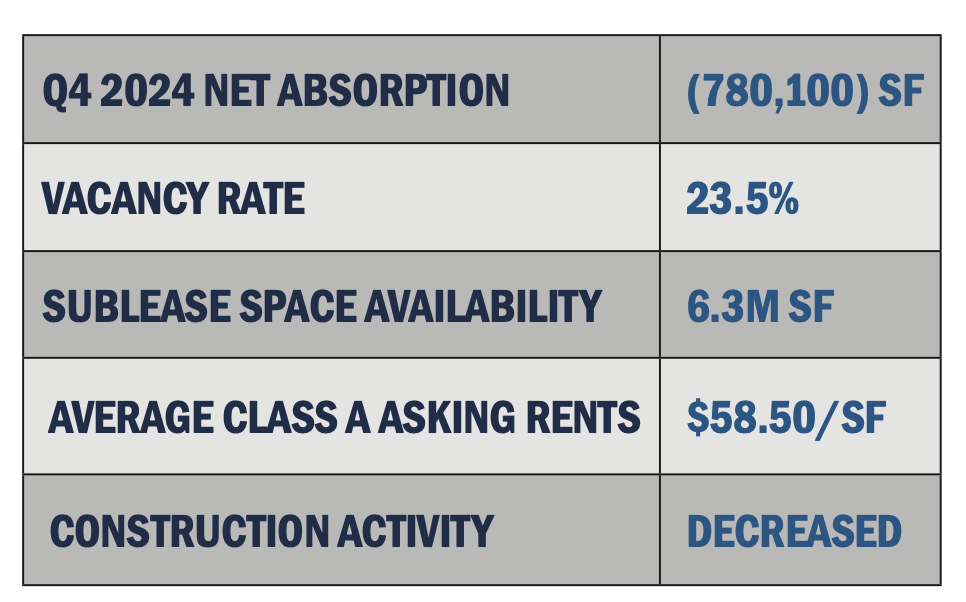

VACANCY: Vacancy remained steady at 23.5% overall in Q4 2024, as the Chicago CBD recorded 780,100 square feet of negative net absorption for direct space during Q4 2024. Sublease availability decreased nearly 4% in Q4, which marked the fourth consecutive quarterly decline in sublease space availability.

ASKING RENTS: Chicago CBD has seen a slight increase in direct asking rents in Q4 2024, with asking rates ranging from:

- Trophy buildings averaging $72.50 per square foot,

- Class A averaging $58.50 per square foot,

- Class B averaging $41.68 per square foot, and

- Class C averaging $28.00 per square foot.

LARGE BLOCKS: There are currently 65 blocks of contiguous large space (100,000 square feet or higher) across 59 buildings in the Chicago CBD.

401 S. State St., former Robert Morris Center, contains the largest block of space with 484,835 square feet of availability. The second largest availability is the former Groupon space at 600 W. Chicago Ave. with 452,832 square feet.

SALE ACTIVITY: Seven office properties changed hands in Q4 2024, bringing the total to 23 buildings that went under new ownership in 2024.

The largest transaction sale was the Hearn Company’s sale of 70 W. Madison St. for $85 million to Mason Asset Management as a joint venture with Namdar Realty Group. This sale represented a 77% drop in building value from its last sold price of $374 million in 2014. The long-term outlook for office investments remains uncertain.

At CBIZ Gibraltar, we are constantly developing innovative and strategic ways to better our results for our clients. With the ever-changing market around us, tenants need a proactive approach to negotiating, evaluating, and managing their real estate needs so they can put their focus on their business goals and objectives.

2025 will be a milestone year for office space users. Whether your real estate plans are immediate or far-off, we would like to get to know you and your office space needs.